Next Generation Payee Verification solution for fraud prevention and out of the box compliance.

'TechnoXander is an EPC-approved Routing and Verification Mechanism (RVM) for Verification of Payee (VoP), the mandatory payee name check for all SEPA credit transfers under the EU Instant Payments Regulation (IPR). Our VoP API enables banks, PSPs, and EMIs across the Eurozone to check payee names in real-time before SEPA payments are authorised, preventing APP fraud and misdirected payments. Delivered via a single Verification of Payee API, TechnoXander VoP solution aims to secure all payments by verifying payee’s name and IBAN before a payment is initiated. Our Verification of Payee solution is easy to integrate and complies with the European Payment Council (EPC), Nordic Payment Council (NPC) and Single Euro Payments Area (SEPA) regulations.

TechnoXander’s Verification of Payee (VoP) solution offers significant advantages for financial institutions and Corporates across the entire Eurozone. By validating payee details in real-time for all SEPA payments, our Verification of Payee solution mitigates the risk of fraudulent transactions and reduces operational costs.

Below are some key benefits you will get with TechnoXander Verification of Payee in Europe:

TechnoXander VoP verifies account details instantly for SEPA instant and SEPA credit transfers.

Our VoP solution is fully compliant with EPC Verification of Payee (VoP) rulebook and guidelines.

TechnoXander VoP API prevents authorised push payment fraud (APP) and misdirected payments.

TechnoXander VoP API reduces manual efforts and minimises operational costs.

TechnoXander VoP API is supplemented by a user-friendly portal to give payment operations an extra edge.

TechnoXander Verification of Payee (VoP) API protects against fines and penalties from regulatory violations.

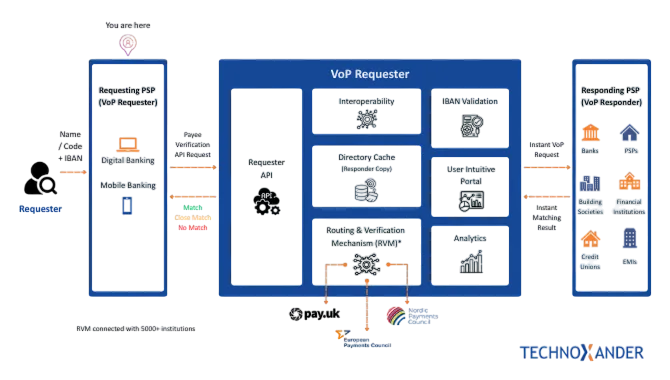

TechnoXander’s VoP Requester provides Payment Service Providers (PSPs), Financial Institutions (FIs), and E-money Institution (EMIs) capability to initiate real-time Verification of Payee (VoP) checks across SEPA Eurozone.

TechnoXander requester obtains payee information via single API, its Routing and Verification Mechanism (RVM) routes request to payee bank and returns matching results to the payer in real-time.

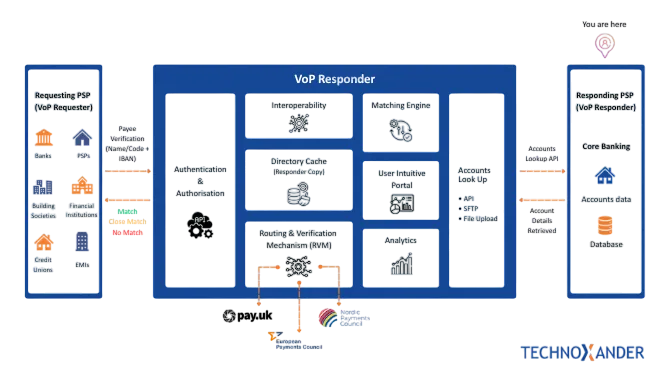

TechnoXander’s VoP Responder allows Account Servicing PSPs (ASPSPs) to respond to incoming VoP requests securely and efficiently.

Built for EPC VoP and IPR compliance, TechnoXander VoP Responder authenticates and authorises incoming VoP requests, queries payee data held at ASPSP and provides matching results by deploying next-gen matching algorithm.

Here’s is a breakdown of key aspects of our Verification of Payee (VoP) API:

Our VoP API checks are conducted in real-time before the payment is authorised. Our name matching algorithm offers Full Match, Close Match, and No Match results will help you prevent fraud and misdirected payments.

Our multinetwork connectivity with EPC, NPC, and Pay.UK supported by our Routing & Verification Engine routes VoP requests to 5000+ institutions and ensuring payee verification from the payee bank.

Our VoP Routing and Verification Engine (RVM) adheres to IPR requirements and EPC VoP standards that ensure different PSPs can communicate and verify payee information seamlessly. We connect with Direct PSPs and other RVMs alike.

Our VoP solution helps to protect consumers from fraud and unauthorised payments in real-time. Moreover, our operations are end-to-end encrypted for completely secured experience.

Our VoP checks are conducted in real-time before the payment is authorised. Our name matching algorithm offers Full Match, Close Match, and No Match results will help you prevent fraud and misdirected payments.

Our multinetwork connectivity with EPC, NPC, and Pay.UK supported by our Routing & Verification Engine routes VoP requests to 5000+ institutions and ensuring payee verification from the payee bank.

Our VoP Routing and Verification Engine (RVM) adheres to IPR requirements and EPC VoP standards that ensure different PSPs can communicate and verify payee information seamlessly. We connect with Direct PSPs and other RVMs alike.

Our VoP solution helps to protect consumers from fraud and unauthorised payments in real-time. Moreover, our operations are end-to-end encrypted for completely secured experience.

- Inquire about joining VoP

- Sign NDA

- Discuss your options

- Complete paperwork

- Implementation discussion

- Agree timeframe

- Become VoP Responder

- Become VoP Requester

- Prevent APP Fraud

According to EPC, all Banks and Financial Institutions had to implement Verification of Payee (VoP) in Europe before 5th October 2025…!

If you are still behind the curve of getting your Verification of Payee solution, get in touch with our experts today.

As we journey across borders and cultures, we forge new connections,

new partnerships, deepen existing relationships, and pioneer opportunities for growth.

Get started quickly with simple guides, a risk-free sandbox environment, real-time insights, and ready-to-use SDKs and plugins for seamless integration.

Verification of Payee (VoP) is a real-time account name-checking service that confirms whether the name of a payment recipient matches the account details held by the recipient’s bank before a credit transfer is executed. Introduced as part of the EU Instant Payments Regulation (IPR), VoP is designed to enhance the safety and reliability of SEPA credit transfers by ensuring that payments are sent to the intended beneficiary.

By verifying the payee’s name or identification details against the account holder information at the receiving bank, the process helps reduce the risk of misdirected payments and authorised push payment fraud. TechnoXander provides a Verification of Payee solution that enables banks and payment service providers to perform these checks instantly while meeting regulatory and scheme requirements.

The deadline for Verification of Payee (VoP) compliance for SEPA payment service providers was 5 October 2025 under the European Payments Council VoP scheme and the Instant Payments Regulation. PSPs operating in the SEPA area were required to implement Verification of Payee (VoP) before the given deadline. If you are behind the curve, TechnoXander can help you become VoP compliant in 2026.

Verification of Payee is mandatory for all Payment Service Providers, EMIs, Credit Unions, and Financial Institutions in scope of EU Regulation 2024/886 (the Instant Payments Regulation). The regulation entered into force on 8 April 2024, with the VoP compliance deadline set for 5 October 2025. TechnoXander's VoP solution is specifically designed to help institutions meet these obligations quickly, with implementation typically completed in under 4 weeks.'

Sending VoP (VoP Requester) is the payment service provider that initiates a Verification of Payee request to confirm the recipient’s account details before a payment is executed.

Receiving VoP (VoP Responder) is the payment service provider that receives this request and returns the verification result by checking the payee name against the account holder details it maintains, which is typically the recipient’s bank.

This interaction allows the sending institution to confirm whether the payment details match before the transfer is completed. TechnoXander provides Verification of Payee infrastructure that supports both VoP requester and VoP responder roles for banks and payment service providers participating in the EPC VoP scheme.

Banks, financial institutions, electronic money institutions, credit unions, and any payment service providers that offer payment accounts and process credit transfers should consider implementing Verification of Payee. These institutions are responsible for ensuring that payments are directed to the correct beneficiary and that appropriate safeguards exist to reduce the risk of misdirected payments or fraud. TechnoXander supports these organisations by providing a Verification of Payee solution designed for banks and payment service providers operating within modern payment schemes.

Yes, TechnoXander provides both VoP Requester and VoP Responder capabilities as part of its Verification of Payee solution. Financial institutions can implement the Requester function to initiate payee verification requests, the Responder function to respond to incoming verification checks, or deploy both depending on their operational role within the payment ecosystem.

Yes, Electronic Money Institutions (EMIs) need to provide Verification of Payee if they offer payment accounts, because they are classified as Payment Service Providers under the relevant payment regulations.

This means EMIs that enable customers to send or receive credit transfers must support payee verification so that account holder details can be checked before a payment is completed. TechnoXander supports EMIs with a Verification of Payee solution that enables them to implement these checks efficiently while participating in the broader VoP ecosystem.

Verification of Payee (VoP) is important because it checks whether the payee name matches the account details before a payment is sent, helping prevent misdirected payments and authorised push payment fraud. This verification step is especially valuable as instant payments become more common, since funds move in real time and are difficult to recover once sent. TechnoXander provides a Verification of Payee solution that enables banks and payment service providers to perform these checks quickly and securely.

Financial institutions should implement Verification of Payee (VoP) now to ensure they meet current payment security expectations and operate in line with evolving regulatory and scheme requirements across Europe.

Implementing VoP early also helps institutions strengthen payment protection by verifying recipient details before a transfer is executed, reducing the risk of payment errors and fraud. TechnoXander enables banks and payment service providers to adopt Verification of Payee efficiently so they can enhance payment security while staying aligned with industry standards.

For a sending PSP, the Verification of Payee process begins when a payer enters the beneficiary details and a VoP request is triggered.

The request is sent to TechnoXander’s VoP Requester, which uses its Routing and Verification Mechanism to identify the correct receiving PSP and route the verification request. The recipient’s bank then checks the account holder information and returns a result indicating a match, close match, or no match, allowing the sending institution to present the outcome to the payer before the payment is completed.

TechnoXander VoP Requester is already integrated with many digital banking channels. Please speak to us to see if you can benefit from zero implementation costs for VoP Requester.

For a receiving PSP, the Verification of Payee process works by receiving incoming payee verification requests from other institutions before a payment is executed.

TechnoXander’s VoP Responder receives the request on behalf of the responding bank and checks the payee name against the account holder information using a smart name-matching algorithm designed to handle variations such as cultural differences and naming conventions. The system then returns a response such as match, close match, or no match in accordance with scheme requirements defined by organisations like EPC or Pay.UK, allowing the requesting PSP to confirm the beneficiary details before completing the payment.

An RVM, or Routing and Verification Mechanism, is the infrastructure that routes Verification of Payee requests between payment service providers and ensures they reach the correct receiving institution for verification.

It acts as a communication layer that enables banks and PSPs to exchange VoP requests and responses across the network.

TechnoXander operates an RVM that connects with more than 5,000 institutions and can route requests either directly to participating PSPs or through other RVMs within the broader VoP ecosystem.

Yes, the Verification of Payee solution is available 24/7/365 to support real-time payment verification at any time. The platform is designed for high availability so banks and payment service providers can perform payee checks continuously without service interruptions.

TechnoXander achieves this reliability through a resilient architecture that includes automated deployments and continuous integration and deployment practices.

Yes, the Verification of Payee solution is designed to comply with major European payment schemes and regulatory frameworks.

It supports scheme requirements defined by organisations such as EPC, NPC, and Pay.UK while aligning with broader regulations including the Instant Payments Regulation, GDPR, and DORA.

TechnoXander ensures that its VoP platform is built to operate within these regulatory and scheme standards so banks and payment service providers can implement payee verification with confidence.

Integrating our Verification of Payee solution into existing systems is straightforward and typically requires minimal changes to payment or digital banking platforms.

The integration is designed to work with common banking channels and core systems so institutions can enable payee verification without major development effort.

TechnoXander has experience integrating VoP capabilities across multiple banking and digital payment environments, allowing many institutions to adopt the solution quickly with limited implementation overhead.

The typical implementation timeline for a Verification of Payee solution is around 4 weeks, depending on the institution’s technical environment and integration requirements. TechnoXander focuses on streamlined onboarding and integration processes to help institutions implement VoP capabilities within this timeframe.

Yes, a user-friendly mechanism is available to initiate payee checks for both manual and bulk payments.

In addition to API-based integration, TechnoXander provides an intuitive front-end portal that allows payment operations teams to perform single or bulk Verification of Payee checks through a simple interface.

The TechnoXander banking suite portal supports multiple users and enables institutions to manage payee verification without relying solely on technical integrations.

Yes, comprehensive support and training are provided to help institutions successfully implement and operate the Verification of Payee solution.

This includes guidance during onboarding as well as assistance for teams responsible for managing and using the system in day-to-day operations.

TechnoXander ensures that banks and payment service providers receive the necessary support and training to use the VoP platform effectively.

Personal data processed through the Verification of Payee solution is protected using strong security and data protection controls. The platform follows strict security standards, including encryption and privacy safeguards, to ensure that sensitive information is handled securely during the verification process. TechnoXander is ISO 27001:2022 certified and designs its VoP solution in line with the technical and security guidelines defined by the European Payments Council.

TechnoXander’s Verification of Payee solution differentiates itself through broad network coverage and a highly advanced name-matching capability designed to deliver accurate verification results. The platform uses sophisticated matching algorithms that account for cultural naming differences, homographs, and other variations that commonly cause false matches in payment verification systems. By improving matching accuracy and reducing false positives, TechnoXander helps banks and payment service providers provide a smoother and more reliable payee verification experience.

Yes, our Verification of Payee solution supports international payment scenarios by enabling institutions to verify payee details across multiple countries and payment networks. This broader reach allows banks and payment service providers to perform payee checks even when transactions involve cross-border payment flows. TechnoXander provides a VoP platform with global connectivity to help institutions verify beneficiaries beyond domestic payment schemes.

The cost of implementing a Verification of Payee solution depends on the institution’s requirements, integration scope, and expected usage levels. Pricing is typically structured to be flexible so banks and payment service providers can adopt payee verification without large upfront investment. TechnoXander offers usage-based and tailored pricing models that allow institutions to scale their VoP deployment according to their operational needs.

Our Verification of Payee solution helps financial institutions reduce payment fraud, minimise misdirected transfers, and improve the overall reliability of payment processing. By verifying recipient details before a transfer is executed, banks and payment service providers can enhance operational efficiency and provide greater confidence to their customers. TechnoXander’s VoP solution also helps institutions operate in line with relevant payment scheme and regulatory expectations while strengthening payment security.

TechnoXander provides dedicated 24X7 customer support to assist institutions using the Verification of Payee solution. Support includes technical assistance and troubleshooting to help banks and payment service providers resolve issues and maintain smooth system operations. The TechnoXander team is available around the clock to ensure reliable service and timely response when support is needed.

You can contact the support team through multiple channels including phone, email, or live chat for assistance with the Verification of Payee solution. These options allow banks and payment service providers to quickly reach the right team for technical help or general enquiries. TechnoXander ensures that institutions can easily get in touch whenever support or guidance is required.

Yes, corporates should use Verification of Payee to confirm that beneficiary details are correct before initiating payments. This verification step helps prevent common payment fraud risks such as invoice fraud, impersonation fraud, and CEO fraud by ensuring that the recipient’s name matches the account details before funds are transferred. TechnoXander provides Verification of Payee capabilities that organisations can use to strengthen payment controls and reduce the risk of fraudulent or misdirected transactions.

Join Our Newsletter for the Latest Updates.

At TechnoXander, we drive payments innovation with agility and adaptability. Headquartered in London, we empower banks and financial institutions to leverage PSD2, PSD3, Open Banking, and advanced fraud prevention solutions like CoP and VoP. Committed to staying ahead of trends, we invest in cutting-edge financial technology while maintaining robust security, as reflected in our ISO 27001:2022 certification.