Unveiling Finance Podcast Episode 5: Future of Open Finance, from PSD2 to PSD3

Podcast with Martin Koderisch - presented by TechnoXander.

Unveiling Finance Podcast Episode 4: Exploring Open Finance and Collaborative Coalitions

Podcast with Charlotte Crosswell OBE - presented by TechnoXander.

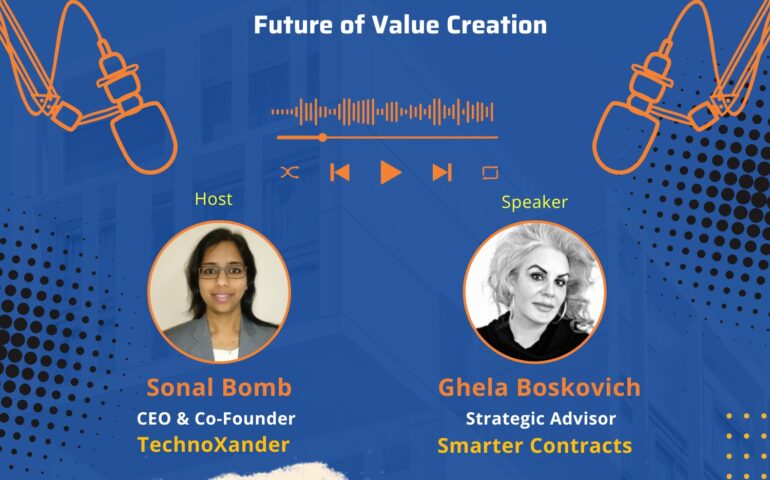

Unveiling Finance Podcast Episode 3: Future of Value Creation

Podcast with Ghela Boskovich - presented by TechnoXander.

Unveiling Finance Podcast Episode 2: Navigating the future of Finance

Podcast with Madush Gupta - presented by TechnoXander.

Unveiling Finance Podcast Episode 1: Demystifying the DPDI Bill

Podcast with Lord Chris Holmes - presented by TechnoXander.

Revolutionizing Euro Payments: European Parliament’s legislative resolution on instant payments

The legislation on instant euro transfer passed by the European Parliament represents a significant advancement in the modernization and standardization of financial transactions throughout the EU. The regulation lays the groundwork for a more efficient, secure, and transparent digital payment ecosystem by promoting competition and innovation, strengthening safety measures, imposing liability requirements, and permitting 24/7 instantaneous payments. As the European Parliament legislation has been adopted, there are some serious changes forecasted in the near future.

Strengthening Financial Security: The Australian Banking Sector’s Confirmation of Payee Initiative

Australia has made significant advances in safeguarding people and businesses with its proactive approach to combating financial scams, as demonstrated by the Scam-Safe Accord and the Confirmation of Payee system. In the end, the phased deployment approach guarantees flexibility and adaptation, which helps to make everyone in Australia's financial future safer and more secure. Collaboration between the banking sector, technology companies, and the general public fortifies the community's resistance against fraud and opens the door for a thriving financial ecosystem.

A Look Back at Six Years of Open Banking

Over the past six years, Open Banking in UK has grown significantly and changed the way we make payments. Thanks to its emphasis on affordability, security, and ease of use, Open Banking-enabled payments are set to take the lead in the digital payments space. To realise Open Banking's full potential, collaboration as well as backing will be essential along the way.

Navigating the Landscape of APP Fraud Prevention: Unpacking the June 2023 Policy

The impending reimbursement requirement for Authorised Push Payment (APP) scams, outlined in the June 2023 Policy Paper by PSR, heralds transformative changes in the financial sector. This breakdown scrutinises the policy's intricacies, encompassing the scope, limits, exceptions, and critical enhancements to the reimbursement framework. Targeting UK Faster Payments system participants, including high-street banks and payment firms, the policy introduces the novel concept where receiving PSPs are mandated to share 50% of the reimbursement burden, bolstered by a defined timeline and ultimate backstop. A pragmatic extension of the reimbursement period to five business days acknowledges operational complexities.

Unveiling Confirmation of Payee – Exploring the Boundaries: Understanding the Scope of Confirmation of Payee Payments

The blog delves into CoP's influence in Faster Payments, internal transfers, Bacs Direct Credit Payments, Direct Debit Payments, and Open Banking Initiated Payments, emphasising its role in enhancing transaction security. CoP's applicability to both personal and business accounts is highlighted through its meticulous name verification process. However, traditional cheque transactions, cash payments, and card-based transactions remain outside CoP's immediate scope. Looking ahead, the blog anticipates CoP's expansion to 400 more financial firms by October 2024, with plans to include corporate and aggregator access, reflecting ongoing advancements in the financial industry's pursuit of enhanced security and trustworthiness.