Next Generation Payee Verification solution for fraud prevention and out of the box compliance.

TechnoXander Verification of Payee (VoP) is a cutting-edge solution for all your payee verification checks when processing SEPA Payments. Our Verification of Payee (VoP) solution verifies payee details such as name or identification before SEPA payments are authorised, putting an extra layer of security to prevent APP fraud. Delivered via a single Verification of Payee API, TechnoXander VoP solution aims to secure all payments by verifying payee’s name and IBAN before a payment is initiated. Our Verification of Payee solution is easy to integrate and complies with the European Payment Council (EPC), Nordic Payment Council (NPC) and Single Euro Payments Area (SEPA) regulations.

TechnoXander’s Verification of Payee (VoP) solution offers significant advantages for financial institutions and Corporates across the entire Eurozone. By validating payee details in real-time for all SEPA payments, our Verification of Payee solution mitigates the risk of fraudulent transactions and reduces operational costs.

Below are some key benefits you will get with TechnoXander Verification of Payee in Europe:

TechnoXander VoP verifies account details instantly for SEPA instant and SEPA credit transfers.

Our VoP solution is fully compliant with EPC Verification of Payee (VoP) rulebook and guidelines.

TechnoXander VoP API prevents authorised push payment fraud (APP) and misdirected payments.

TechnoXander VoP API reduces manual efforts and minimises operational costs.

TechnoXander VoP API is supplemented by a user-friendly portal to give payment operations an extra edge.

TechnoXander Verification of Payee (VoP) API protects against fines and penalties from regulatory violations.

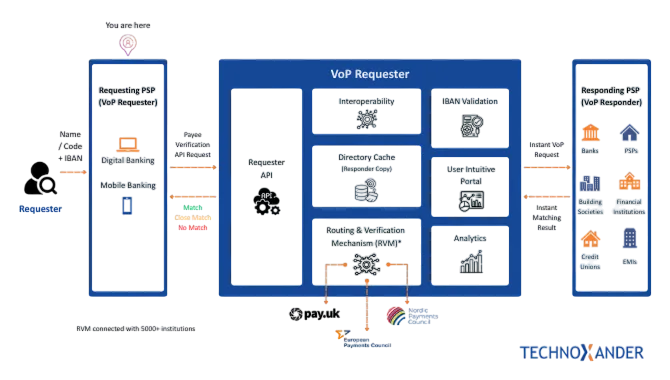

TechnoXander’s VoP Requester provides Payment Service Providers (PSPs), Financial Institutions (FIs), and E-money Institution (EMIs) capability to initiate real-time Verification of Payee (VoP) checks across SEPA Eurozone.

TechnoXander requester obtains payee information via single API, its Routing and Verification Mechanism (RVM) routes request to payee bank and returns matching results to the payer in real-time.

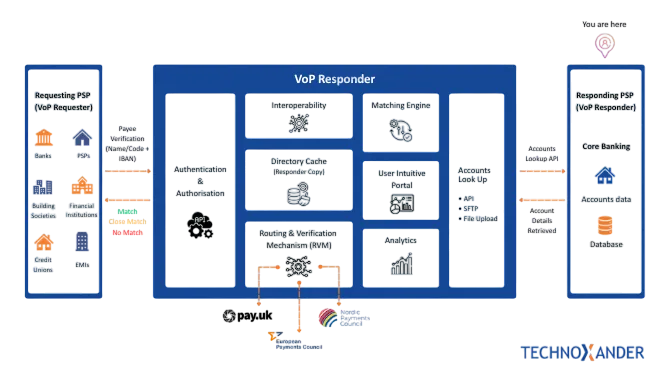

TechnoXander’s VoP Responder allows Account Servicing PSPs (ASPSPs) to respond to incoming VoP requests securely and efficiently.

Built for EPC VoP and IPR compliance, TechnoXander VoP Responder authenticates and authorises incoming VoP requests, queries payee data held at ASPSP and provides matching results by deploying next-gen matching algorithm.

Here’s is a breakdown of key aspects of our Verification of Payee (VoP) API:

Our VoP API checks are conducted in real-time before the payment is authorised. Our name matching algorithm offers Full Match, Close Match, and No Match results will help you prevent fraud and misdirected payments.

Our multinetwork connectivity with EPC, NPC, and Pay.UK supported by our Routing & Verification Engine routes VoP requests to 5000+ institutions and ensuring payee verification from the payee bank.

Our VoP Routing and Verification Engine (RVM) adheres to IPR requirements and EPC VoP standards that ensure different PSPs can communicate and verify payee information seamlessly. We connect with Direct PSPs and other RVMs alike.

Our VoP solution helps to protect consumers from fraud and unauthorised payments in real-time. Moreover, our operations are end-to-end encrypted for completely secured experience.

Our VoP checks are conducted in real-time before the payment is authorised. Our name matching algorithm offers Full Match, Close Match, and No Match results will help you prevent fraud and misdirected payments.

Our multinetwork connectivity with EPC, NPC, and Pay.UK supported by our Routing & Verification Engine routes VoP requests to 5000+ institutions and ensuring payee verification from the payee bank.

Our VoP Routing and Verification Engine (RVM) adheres to IPR requirements and EPC VoP standards that ensure different PSPs can communicate and verify payee information seamlessly. We connect with Direct PSPs and other RVMs alike.

Our VoP solution helps to protect consumers from fraud and unauthorised payments in real-time. Moreover, our operations are end-to-end encrypted for completely secured experience.

- Inquire about joining VoP

- Sign NDA

- Discuss your options

- Complete paperwork

- Implementation discussion

- Agree timeframe

- Become VoP Responder

- Become VoP Requester

- Prevent APP Fraud

According to EPC, all Banks and Financial Institutions had to implement Verification of Payee (VoP) in Europe before 5th October 2025…!

If you are still behind the curve of getting your Verification of Payee solution, get in touch with our experts today.

As we journey across borders and cultures, we forge new connections,

new partnerships, deepen existing relationships, and pioneer opportunities for growth.

Get started quickly with simple guides, a risk-free sandbox environment, real-time insights, and ready-to-use SDKs and plugins for seamless integration.

To make payments more accessible and safer, the Instant Payments Regulation (IPR) has introduced guidelines to enhance the security of SEPA credit transfers within the EU. One key aspect of these guidelines is the verification of payee (VoP).

VoP is a real-time verification payee name or identification check against account holder details at the payee’s bank, ensuring the credit transfer goes to the correct recipient.

VoP acts as a safeguard, reducing the risk of errors and fraud.

All SEPA (Single Euro Payments Area) member PSPs are to comply with the guidelines set by the European Payment Council by 5 October 2025.

Sending VoP (VoP Requester): This refers to the entity initiating the payment transaction and sending a request for verification of payee details to the VoP responder.

Receiving VoP (VoP Responder): This refers to the entity receiving the VoP request and providing the necessary verification information. The VoP responder is typically the recipient's bank or payment service provider.

Yes, TechnoXander offers both VoP Requester and VoP Responder modules. Financial Institutions can choose to offer both or just Sending/Receiving capabilities depending on their requirement.

EMIs that offer payment accounts are considered PSPs and must comply with the VoP requirements.

VoP reduces APP fraud, reduces misdirected payments, and enhances customer trust. It is especially important as PSPs in Eurozone will now provide Instant Payments which generally carry higher risks.

Every in-scope financial institution in Europe should implement VoP right away. As it gives you:

1. Compliance with evolving regulation – it helps you meet the latest payment security standards

2. Lead against your peers – set yourself apart with superior payment protection provider

3. Zero the payment error – it helps you verify the payment details upfront

The request for Payee check is sent to TechnoXander VoP Requester.TechnoXander VoP requester leverages its Routing and Verification Mechanism to route request to payee PSP.

Upon receiving response from Payee PSP, TechnoXander VoP requester confirms a Match, Close Match, or No Match message for Payer.

TechnoXander VoP Requester is already integrated with many digital banking channels. Please speak to us to see if you can benefit from zero implementation costs for VoP Requester.

TechnoXander VoP Responder receives the payee verification request on behalf of responding bank.

VoP Responder module comes with smart name-matching algorithm which can account for cultural differences, naming conventions etc. to return a matching response in line with requirements set by NPC, EPC or Pay.UK.

RVM stands for Routing and Verification Mechanism. An RVM works as a medium between banks and other RVMs.

TechnoXander as RVM connects with 5000+ institutions. TechnoXander RVM has capabilities of connecting directly with PSPs or routing via other RVMs.

Our VoP solution is available on a 24/7/365 and is designed for high availability ensuring uninterrupted service.

We achieve this by incorporating zero touch deployments, Continuous Integration and Continuous Deployments in design.

Absolutely, our solution is fully compliant with EPC , NPC, Pay.UK schemes.

We are fully compliant with Instant Payment Regulations, GDPR and DORA so you have nothing to worry about!

Our approach ensures a smooth integration process with minimal disruption.

Our team has extensive experience in integrating VoP solutions. We have already integrated with numerous digital banking and core banking platforms, which means that for many institutions, the setup requires little to no additional integration time or costs.

This allows you to quickly adopt our solution without the need for extensive development work or significant investment.

The implementation timeline can vary depending on your specific requirements, but we aim to deliver in 6-8 weeks.

We understand not everyone likes to use API and so, we have provided a user intuitive front-end portal. Our banking suite enables payment operations team to perform single and bulk payee checks via user friendly portal. Our banking suite portal does not have limitations of number of users, and we do not charge for portal use based on number of users.

Yes, we provide full assistance and training to ensure successful implementation and ongoing use of our solution.

We are ISO27001:2022 certified which ensures data protection for all personal data. We employ robust security measures, including encryption and data privacy protocols, to protect your data. We adhere to and implement all technical guidelines of the European Payments Council (EPC) in our VoP product.

Our solution offers global coverage, advanced matching algorithm accounting for cultural differences, homographs and biases to provide accurate name matching results reducing false positives.

Yes, our solution has a global reach, enabling you to verify payees in various countries.

Our pricing is economical and tailored to your specific needs. We offer usage based flexible pricing models to meet your budget.

Our solution can help you reduce fraud, improve operational efficiency, enhance customer satisfaction, and comply with regulatory regulations.

We provide dedicated customer support 24x7, including technical assistance and troubleshooting.

You can reach our support team by phone, email, or live chat.

Corporates must modify their systems to make use of Verification of payee services to prevent APP fraud especially invoice fraud, impersonation fraud and CEO fraud.

Join Our Newsletter for the Latest Updates.

At TechnoXander, we drive payments innovation with agility and adaptability. Headquartered in London, we empower banks and financial institutions to leverage PSD2, PSD3, Open Banking, and advanced fraud prevention solutions like CoP and VoP. Committed to staying ahead of trends, we invest in cutting-edge financial technology while maintaining robust security, as reflected in our ISO 27001:2022 certification.