Verification of Payee (VoP) is a new layer designed to verify payee before anyone triggers a transaction in Europe.

In an age where digitisation is taking over, better security and accuracy of financial transactions is a must. To address the modern cybersecurity measures in financial domain, the European government has released its Verification of Payee (VoP) guidelines to revolutionise the banking system across Europe.

Considering this, we are here with this detailed guide to answer all the essential questions regarding VoP in 2026, that includes:

- What is Verification of Payee?

- How does VoP work?

- What are the benefits of VoP for businesses?

- Explain TechnoXander Verification of Payee API in detail.

- What is VoP Routing and Verification (RVM) Mechanism?

- Is Verification of Payee (VoP) the ultimate fraud prevention measure in 2026?

- What is Verification of Payee deadline in Europe?

- How to choose the best Verification of Payee vendor in Europe?

- What are the challenges EU might face while implementing VoP?

We aim to educate every in-scope authority with essential VoP guidelines for easy implementation. In-case you are in hurry, you can also consider getting though these summary points containing key information from this detailed guide:

- Verification of Payee (VoP) is now a mandatory requirement under the EU’s Instant Payment Regulation (IPR) to prevent fraud in SEPA Credit Transfers (SCT & SCT Inst) by verifying the payee’s name against their IBAN before payment is processed.

- VoP API works when a Requesting PSP sends payee details (name, IBAN, identifier) to a Responding PSP for real-time verification; the response (match, partial match, no match) is instantly relayed to the payer to ensure accurate transactions.

- RVM acts as the core infrastructure ensuring the correct routing of requests and responses between PSPs while validating payee details before transaction authorization — reducing misdirected or fraudulent payments.

- Over 4,000 institutions in Europe — including banks, PSPs, EMIs, and salary processors — are in scope and must implement VoP in 2026 or risk non-compliance and financial fraud exposure.

- VoP reduces APP fraud, misdirected payments, and operational costs, while improving trust, customer experience, and regulatory alignment in digital payments across Europe.

- Key hurdles include technical integration, consumer adoption, and economic disparities across EU regions that may affect uniform rollout and system readiness.

- VoP is not a standalone fraud prevention solution, but a powerful add-on layer that strengthens existing fraud controls through payee verification and real-time feedback in SEPA payments.

Here’s how VoP could be changing things for financial and safety precision:

What is Verification of Payee (VoP)?

Verification of Payee (VoP) will play an important role in the new Instant Payment Regulation (IPR). It is created with rules, practices and standards adhering to an inter-payment service provider (PSP) to prevent immediate and irrevocable transfers from happening under the Single Euro Payments Area (SEPA) credit transfers.

How does VoP work?

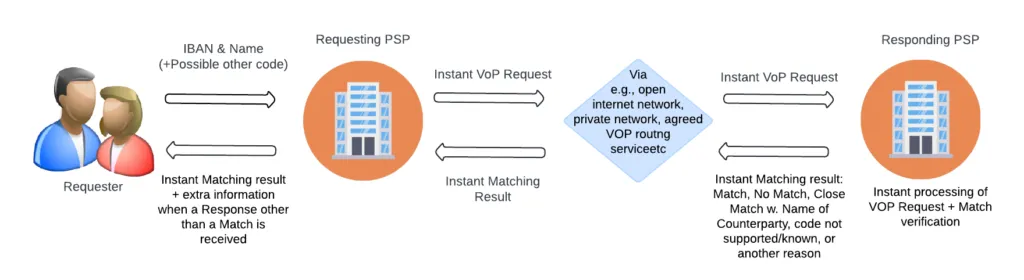

The Verification of Payee is a scheme developed by the European Payment Council to prevent payment fraud. It involves improving customer satisfaction and building trust in SEPA account-to-account transfers with immediate feedback on the payee verification.

- The payee verification scheme allows the Payment Service Provider (PSP) of the payer (the Requesting PSP) to instantly send to the PSP of the payee (the Responding PSP), a request for payee IBAN and name verification as given by the payer (the Requester).

- In addition, an unequivocal identification code (e.g., Value-Added Tax (VAT) number, a Legal Entity Identifier (LEI), social security code) about that payee. The reason behind this is that the payer intends to initiate a SEPA Credit Transfer (SCT) or a SEPA Instant Credit Transfer (SCT Inst) transaction with the payee.

- The Responding PSP will then instantly verify whether the received data aligns with the concerned data registered for that payee at the Responding PSP.

- The Requesting PSP will immediately be informed by the Responding PSP with a VOP response (e.g., match, no match, or close match with the payee, match/verification check not possible).

- The Requesting PSP then immediately passes on the response to the payer to avoid misdirected payments.

The Verification of Payee (VoP) routing and verification mechanism is advanced and secured enough to reduce APP scams across the entire European Union.

What does the Implementation of Verification of Payee (VoP) mean for Europe?

This brings along with it a minimum VOP service level that ensures pan-European acceptance and reach. VOP solutions or schemes must come with an interoperability “by design”.

The implementation is supported by PSPs of an EU legislative obligation that offers VOP services to their customers to avoid misdirected payments from happening due to fraudulent partners.

Who are in Scope for Verification of Payee (VoP) in 2026?

Under the EU Instant Payments Regulation (IPR), Verification of Payee (VoP) becomes a mandatory requirement for Payment Service Providers (PSPs) operating within the Single Euro Payments Area (SEPA). In 2026, VoP will no longer be optional infrastructure, it will be a regulatory obligation for institutions that send or receive credit transfers in euro.

What are the Benefits of VoP for Businesses?

The sharing data can be gathered by businesses to study their target audiences and used to create custom outlines to build loyalty.

- To ensure pan-European acceptance and reach can be achieved, it establishes a minimum level of VOP service

- Ensures as much possible real-time data exchange “by design” with any existing VOP solutions or schemes

- Adoption of the scheme across Europe means businesses can get access to data on a wider scale

- It prevents misdirected payments saving cost and time

- Improves the end-user experience and trust in SEPA Instant Credit Transfers

What is Verification of Payee API?

Verification of Payee API is a technology that helps you leverage the power of VoP in your existing payment software. You can simply integrate the TechnoXander VoP API in your current digital payment solution to use all the VoP functionalities without affecting or changing your existing facilities.

Many companies are building Verification of Payee (VoP) solutions but many others do not have required resources to build a VoP supporting software. Hence, these companies can use this VoP API integration to make secure payment transactions.

What is Routing and Verification Mechanism (RVM) in VoP?

RVM, or Routing and Verification Mechanism, is a critical component of the Verification of Payee (VoP) process in Europe. It works as a bridge between different schemes and solutions for PSPs. RVM involves a series of steps to validate the payee’s identity and account details before authorizing a transaction.

RVM (Routing and Verification Mechanism) is like a gatekeeper for your money. When you want to send money to someone, RVM checks to make sure it’s going to the right person.

For Example:

Imagine you’re sending a letter to a friend. You’d write their address on the envelope. RVM is like the postal worker who checks the address to make sure it’s correct and sends the letter to the right place.

Similarly, when you send money, RVM checks the recipient’s bank account number and other details to ensure it matches the person you’re trying to pay. This helps prevent mistakes and keeps your money safe.

How does RVM work?

- Data Collection: The RVM collects essential information from the payer, including the payee’s name, account number, and bank details.

- Data Validation: The RVM verifies the accuracy and consistency of the collected data against reliable databases and reference sources.

- Routing: Once the data is validated, the RVM determines the appropriate routing path for the transaction based on the payee’s bank and location.

- Verification: The RVM sends a verification request to the payee’s bank to confirm the accuracy of the account details and to obtain additional information if necessary.

- Authorization: If the verification is successful, the RVM authorizes the transaction to proceed.

What is Verification of Payee Technology for Organisations?

The use of Verification of Payee technology is not limited to banks and financial institutions. Every organisation transferring salaries and sending money every month for various assets can also add an extra protection layer on all transactions by integration VoP solution in their existing payment software.

What is Verification of Payee (VoP) Deadline in Europe?

According to the officials, the Verification of Payee (VoP) deadline in Europe was 5 October 2025. However, not all organisations implemented VoP till the last date.

Getting VoP is not essential only to address the government’s directives but also to safeguard your financial services in every aspect. Hence, we recommend all banks, financial institutions, and money exchange service providers to either build their VoP solution or get it from a verified and established fintech company to safeguard all their financial services.

How to Pick the Best Verification of Payee Vendors in Europe?

You can find many Verification of Payee vendors across the European Union countries. However, we recommend opting for an experienced VoP vendor approved by the payment associations or authorised by any government entity.

Moreover, checking the background of the VoP vendor is equally important as you will not want to choose an unexperienced VoP vendor. You can try contacting companies like TechnoXander, which has a decent experience in developing and delivering open banking, Confirmation of Payee and Verification of Payee solutions.

What are the challenges EU might face while implementing VoP?

Like any other government directive, Verification of Payee (VoP) implementation comes with a few challenges that you can check below:

- Technical Difficulties: Adding VoP on site of an existing system would require careful coordination and planning. It would require PSPs and the banking system to work together to ensure the effectiveness of the scheme.

- Acceptance: Getting consumers to adopt the scheme is crucial for the success of the scheme. Otherwise, it may result in a similar failure experienced by the UK with its Open Banking scheme.

- Financial Inequality: Varying economic conditions across European countries could mean that not all regions can afford the required integrations and upgrades.

What are the Rules to be Followed in accordance with VoP Guidelines?

A set of inter-PSP rules and requirements are set for a smooth operation under the scheme:

Eligibility of Participants

- Partners of the scheme must be licensed PSPs in SEPA-authorised countries

- The applicant must be financially sound and meet solvency and liquidity requirements as well as other financial and regulatory requirements including anti-money laundering requirements and risk control measures.

Requirements for Operation

- Users can operate services using Routing and Verification Mechanisms (RVMs) or Intermediary PSPs.

- Must be able to operate in compliance with the scheme and be reachable across SEPA.

- Handle situations pertaining to reachability.

Partner Responsibility

- Comply with the processing rules for VoP applications and answers.

- Ensure that all linked employees and agents act in accordance with the Rulebook.

In a nutshell, the Verification of Payee has the potential to change financial transactions in Europe for the better and make them more secure and trusted. Sure, there is no denying that there will be obstacles around implementation costs and technical issues, but its users will reap the benefits of its placement in SEPA.

How does Verification of Payee (VoP) in 2026 Look Like?

More than 4000 institutions are in scope for Verification of Payee (VoP) solution says the European Payments Council (EPC).

Hence, we recommend all the in-scope institutions to follow these metrics while selection a Verification of Payee (VoP) vendor for their organisations:

- Easy to integrate API

- 24/7 support

- High-end name matching algorithms

- Prior fintech experience

- Compliance friendly ecosystem

- Smart name-matching algorithms

Is Verification of Payee (VoP) The Ultimate Fraud Prevention Measure in 2026?

If you consider Verification of Payee (VoP) as the ultimate fraud prevention measure then you are not in the right direction of understanding it. VoP works as an additional layer of cyber security for all your financial transactions.

In simple words, Verification of Payee (VoP) strengthen your existing financial fraud prevention measures buy providing a high-end name and iban verification facility to it.

Number of Companies Adopted Verification of Payee in 2025

Below you can see a list of European countries along with the number of companies in that county adopted Verification of Payee solution in 2025:

| Name of Country | Number of Companies Adopted VoP in 2025 |

| Austria | 380 |

| Belgium | 34 |

| Bulgaria | 3 |

| Switzerland | 1 |

| Cyprus | 21 |

| Czech Republic | 8 |

| Germany | 1102 |

| Denmark | 4 |

| Estonia | 7 |

| Spain | 102 |

| Finland | 11 |

| France | 187 |

| Great Britain | 2 |

| Greece | 19 |

| Croatia | 20 |

| Hungary | 1 |

| Ireland | 175 |

| Iceland | 1 |

| Italy | 361 |

| Jersey | 1 |

| Lithuania | 69 |

| Luxembourg | 52 |

| Latvia | 16 |

| Malta | 27 |

| Netherlands | 28 |

| Norway | 1 |

| Poland | 1 |

| Portugal | 32 |

| Romania | 1 |

| Sweden | 3 |

| Slovenia | 13 |

| Slovakia | 13 |

Is TechnoXander Verification of Payee (VoP) API the Best in Market?

TechnoXander is one of the EPC certified Verification of Payee (VoP) providers in Europe that offers cutting-edge VoP API for banks and financial institutions in Europe.

Our VoP API has two modules listed below:

- Verification of Payee (VoP) Requester Module

- Verification of Payee (VoP) Responder Module

Every bank or financial institution can pick any other these or both modules based on their requirements. Let us now understand how these VoP modules work in detail:

What is Verification of Payee (VoP) Requester Module?

The TechnoXander VoP Requester API is ideal for banks and financial institution, who are dependednt on a bigger entity for database.

What is the role of the requester in the Verification of Payee process?

The role of the requester in the VoP process is to initiate a payee name check request before a payment is made or when a new payee is added. The requester, typically a bank, payment service provider (PSP), or EMI, sends the payee’s account details — such as name, account number, and sort code or IBAN — to the responder.

The requester is responsible for collecting accurate beneficiary information and integrating a VoP API such as TechnoXander’s Verification of Payee Requester API into their digital banking or payment platforms. Their main responsibilities include:

- Triggering VoP checks when payment is initiated and before payment authorisation

- Receiving match results (match, partial, no match) from the Verification of Payee API response

- Ensuring customer-facing messages are clear and actionable for results received.

How can requesters ensure they are meeting VoP compliance requirements?

To meet VoP compliance requirements, requesters must follow the regulatory and technical guidelines set by the European Payments Council (EPC)/ This includes:

- Implementing VoP checks for relevant payment types, especially SEPA Instant Credit Transfers (SCT Inst) and SEPA payments.

- Using secure APIs build on EPC Inter PSP API guidelines to ensure interoperability.

- Handling match results properly and informing users clearly without breaching privacy laws.

- Maintaining audit trails for all VoP requests and responses.

- Keeping up with EPC VoP deadlines and the Instant Payments Regulation timelines across the EU.

By aligning with these standards, requesters ensure both regulatory compliance and enhanced fraud prevention.

What data do requesters need to provide for Verification of Payee?

The data required by requesters for VoP typically includes:

- Account holder name or Account Identifier such as Tax ID, SIRET, SIREN, DUNS (as entered by the payer)

- IBAN in SEPA zone

Requesters can leverage Routing and Verification Mechanisms such as TechnoXander to provide this information and obtain matching results.

How do requesters benefit from the Verification of Payee system?

Requesters benefit from VoP in several impactful ways:

- Reduced fraud and misdirected payments: VoP helps catch incorrect account details before money leaves the payer’s account.

- Enhanced customer trust: By verifying payee details, customers feel safer using digital banking services.

- Regulatory compliance: Ensures adherence to the Instant Payments Regulation and other anti-fraud mandates.

- Improved operational efficiency: Fewer failed payments and reduced manual investigations.

- Better customer experience: Reduces user errors and gives users confidence with real-time validation feedback.

What is Verification of Payee (VoP) Responder Module?

The TechnoXander VoP Responder API is ideal for big banks and financial entities who have their own data bases and some credit unions or payment Institutions working with them.

When a Paying PSP (Payment Service Provider) initiates a VoP check (before a payment is made), it sends a request to verify the account name and number/IBAN. This request reaches the Responder module of the Receiving PSP, which hosts the target account.

What is the role of the responder in the Verification of Payee process?

In the Verification of Payee (VoP) process, the Responder PSP is the bank or payment provider that holds the payee’s account, and its role is to confirm whether the account details provided by the sender actually match. When a payment is initiated, the sender’s bank (the Requester) sends a check to the Responder, asking if the account number (IBAN) really belongs to the name entered by the customer.

The Responder then compares the name it receives with the official account name it has on record and sends back a response — confirming a match, flagging a close but not exact match, or rejecting the details if they don’t align. This role is critical because it acts as the “source of truth” in the VoP ecosystem: without the Responder’s confirmation, there would be no reliable way to verify that money is being sent to the right person or business.

By doing this instantly, the Responder helps prevent fraud, reduce misdirected payments, and ensure compliance with the EPC’s Instant Payments Regulation, making payments both safer and more trustworthy for customers across Europe.

How can responders ensure they are meeting VoP compliance requirements?

To meet VoP compliance requirements, responders must follow the regulatory and technical obligations set by the European Payments Council (EPC). This includes:

- Processing incoming VoP requests accurately and returning results (Match, Close Match, No Match) in line with EPC guidelines.

- Using secure APIs based on EPC Inter-PSP API standards to guarantee interoperability and data protection.

- Protecting customer data and privacy by only returning the minimum information required, without exposing unnecessary details.

- Maintaining comprehensive logs of all incoming requests and outgoing responses for audit and dispute resolution.

- Ensuring service availability and performance, with appropriate monitoring and SLAs to meet scheme expectations.

- Staying updated with EPC VoP rulebooks and Instant Payments Regulation deadlines to remain compliant as requirements evolve across the EU.

By aligning with these obligations, responders help strengthen payment security, build ecosystem trust, and support the wider adoption of Instant Payments in Europe.

What data do responders need to provide for Verification of Payee?

The data required by responders for VoP typically includes:

- Account holder name (as stored by the bank/PSP)

- Account Identifier (e.g., IBAN in SEPA zone, sort code & account number in the UK, or other unique identifiers depending on the region)

- Associated reference data such as account status (active/closed) or type (personal/business) where applicable

Responders use secure API connections and compliance-driven mechanisms to return a match, close match, or no match result to the requester.

How do responders benefit from the Verification of Payee system?

Responders gain several key advantages from implementing VoP:

- Reduced financial risk: Responders can prevent unauthorized or fraudulent credits to accounts by validating incoming payment details in real time.

- Regulatory compliance: Helps ensure adherence to Instant Payments Regulation, anti-money laundering (AML), and fraud-prevention mandates.

- Operational efficiency: Minimizes manual reconciliation and reduces the burden of investigating misdirected payments.

- Improved customer trust: Customers are assured that only verified payees can receive funds, enhancing confidence in your banking services.

- Better resource allocation: Automated validation reduces errors and frees up staff to focus on higher-value tasks rather than exception handling.

When Verification of Payee (VoP) Fails?

VoP can fail when institutions treat it as a technical requirement rather than part of a broader fraud and decisioning strategy.

A “match” result only confirms that the entered name aligns with the account holder data. It does not assess intent or detect social engineering. In Authorised Push Payment (APP) scams, victims are often coached to input the exact registered name, increasing the likelihood of a positive match and reinforcing false confidence.

VoP also loses effectiveness when name-matching logic is poorly calibrated. Overly strict configurations generate excessive mismatches and customer friction, while overly lenient settings increase fraud leakage. Inconsistent data quality on the responder side further reduces accuracy and can drive disputes.

Operational gaps are another failure point. If VoP is not consistently applied across all channels, including corporate, bulk, and API-initiated payments, fraud will migrate to weaker pathways.

Finally, VoP should not be treated as a standalone fraud solution. It verifies name-to-IBAN alignment, not behavioural anomalies, mule activity, or scam typologies. Without integration into transaction monitoring, behavioural analytics, and clear customer warning design, VoP risks becoming a compliance exercise rather than a meaningful safeguard.

In short, VoP fails when it is implemented as infrastructure alone. Its effectiveness depends on calibration, data integrity, channel coverage, and integration into the broader fraud control framework.

How can Verification of Payee (VoP) Experts at TechnoXander Help?

Verification of Payee (VoP) is undeniably a great reform in the financial market to minimise APP scams. However, finding a suitable Verification of Payee (VoP) expert is another big challenge. To overcome this, TechnoXander, with its extensive expressing in offering banking solutions has built a VoP API for every business. Below are some highlighting features of our VoP API:

- API-driven solutions

- Sandbox support

- Real-time analytics

- Simplified reporting

- User-friendly interface

With reduced fraud, increased verification and validation in real-time, and better customer confidence, VoP can become the go-to for digital banking in the EU. So yeah, it’s not going to be easy, but let’s see the change it brings to secure payments in Europe! Exciting times ahead!

Don’t wait – enhance your payment security with Verification of Payee (VoP) today, our experts at TechnoXander are there for your assistance.