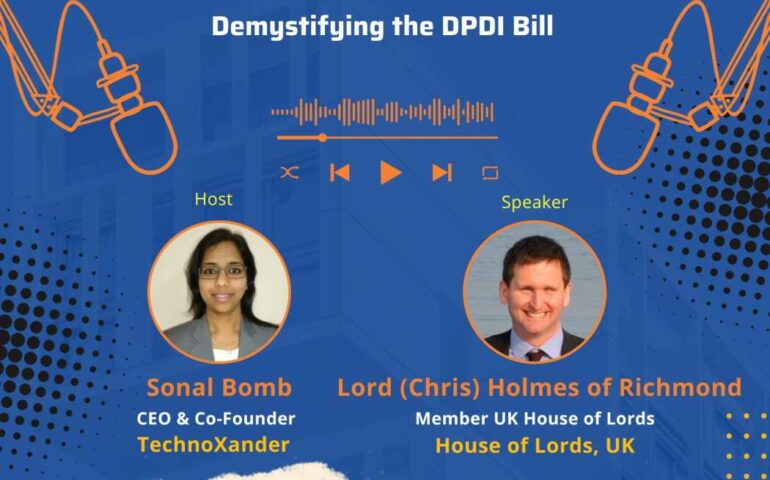

Unveiling Finance Podcast Episode 1: Demystifying the DPDI Bill

Podcast with Lord Chris Holmes - presented by TechnoXander.

A Look Back at Six Years of Open Banking

Over the past six years, Open Banking in UK has grown significantly and changed the way we make payments. Thanks to its emphasis on affordability, security, and ease of use, Open Banking-enabled payments are set to take the lead in the digital payments space. To realise Open Banking's full potential, collaboration as well as backing will be essential along the way.

Unveiling Confirmation of Payee- Navigating Changes in Confirmation of Payee: A Strategic Overview

In the evolving financial technology landscape, significant changes are occurring in Confirmation of Payee (CoP) services, shifting from the Open Banking system to a new directory by Pay.UK. This transition, aimed at enhancing CoP and overlay services, poses challenges and strategic considerations. Pay.UK's decision to create a new directory simplifies the complex three-agreement structure for Payment Service Providers (PSPs), streamlining contracts to Pay.UK only. The new Pay.UK directory, operational in Spring 2024, mandates PSPs to transition from the Open Banking Directory by a specified date. Financial Organisations are advised to assess business benefits, potential risks, and change management strategies.

Empowering Futures: CFIT Open Finance Coalition’s Vision for Financial Transformation

The Centre for Finance, Innovation, and Technology's (CFIT) Open Finance Coalition envisions a transformative financial landscape beyond Open Banking. The initiative aims to empower individuals and SMEs by providing a holistic view of financial ecosystems. Anticipating a 1.5% GDP surge in the UK by 2030, Open Finance is positioned as an economic growth catalyst with an estimated annual benefit of £27.8 billion through personal data sharing. For SMEs, the focus is on overcoming credit access challenges and improving cash flow management. The coalition identifies over 30 datasets crucial for financial transformation, emphasising the data revolution's significance.

CoP solves the growing problem of APP fraud for banks in the UK

Authorised Push Payment (APP) fraud has spread like wildfire in the UK. According to UK Finance, APP fraud increased from £208 million in the initial months of 2020 to £355 million in 2021. The trend followed in the second half of 2021, with APP fraud reaching £819 million. This growth in APP scams is staggering […]

‘Confirmation of Payee’, a.k.a. CoP is combating APP fraud

A drastic surge in Authorised Push Payment (APP) fraud took over the world with a storm during the pandemic. The fraudsters searched for innovative ways to target people and attack their banks and financial institutions for APP fraud. Worldwide lockdown increased digital payment transactions, which worsened the situation irrespective of innumerable security steps integrated by […]